Inflation and Central Bank Policy Are Top of Mind for Investors

Q3 2021, Inflation and Central Bank Policy Are Top of Mind for Investors

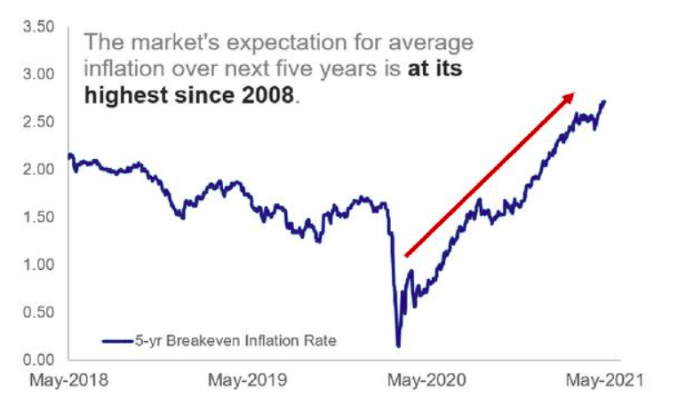

The surge in inflation in 2021 has fueled an intense inflation debate with central banks taking a more benign view that the current rise in inflation is “transitory,” while markets are nervous that the rise in inflation could herald a new phase of higher inflation after decades of low inflation and deflation fears. Major developed central banks, including the US Federal Reserve and European Central Bank, expect that much of the sharp rise in inflation will turn out to be transitory. Several Fed officials commented that the chief sources of rising prices are driven by temporary shortages of key supplies and labor tied to the reopening of the economy.

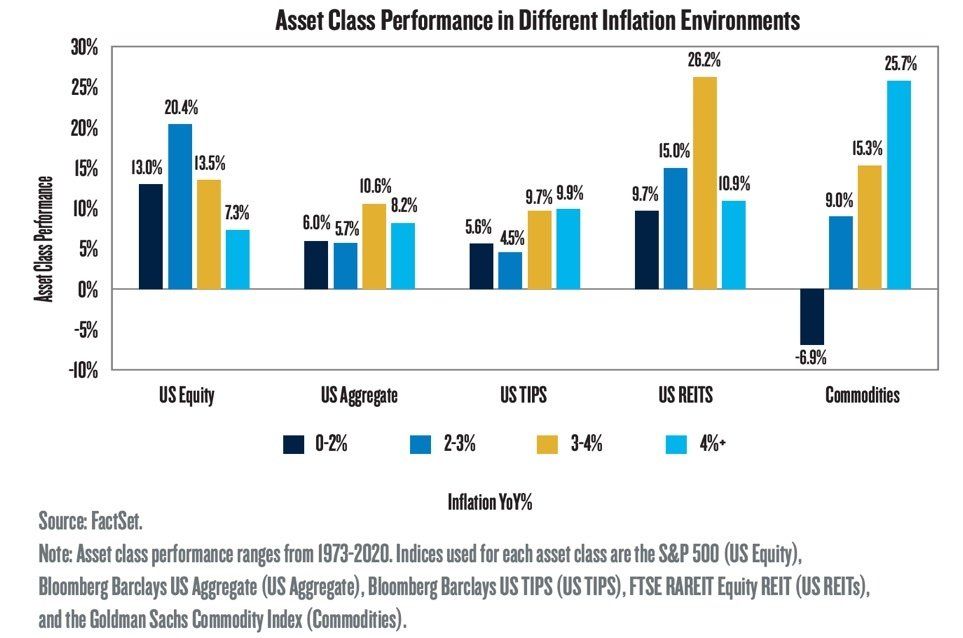

Our view on inflation is that unless labor costs rise across the board, the free markets will resolve supply/demand imbalances, rising prices will cause demand destruction until prices normalize, that said food and energy prices are likely to remain elevated for some time due to recent policy decisions. As shown below, asset class performance in both equities and REITS has historically been quite good in the 3-4% inflation environment we foresee, gradually rising but controlled inflation is a byproduct of a growing economy and supportive of rising earnings and equity prices.

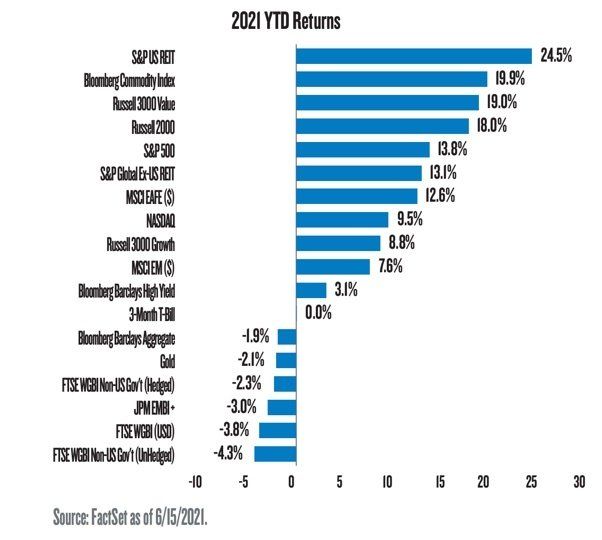

The above table shows 2021 asset classes have performed consistent with historical norms given a 3-4% inflationary environment, in other words the free markets have accurately priced in the current environment, but you may be wondering – where do we go from here?

Let’s Consider Global Central Bank Policy

Developed market central banks remain on hold as they consider rising inflation to be a “transitory” phenomenon. The Fed expects to keep rates at zero until 2023 but has been signaling that it is time to “start thinking” about tapering quantitative easing purchases. For now, the Fed is likely to keep the pace of its purchases at the current level but may begin reducing the pace of its purchases by early next year. Meanwhile the ECB has committed to increasing purchases in Q3 2021 relative to earlier in the year, while likely preparing the ground for a very gradual tapering of purchases in the fourth quarter.

The Bank of Canada has already announced it will begin QE tapering. There is also the possibility that the Bank of England will let its QE purchases expire in the second half of 2021. Among emerging markets, there is a split between those central banks that have begun down a normalization path as the recovery gains strength and financial stability concerns (i.e., concerns about excess risk taking) move to the fore, and other central banks still grappling with virus-related downside risks. In China, one of the first major economies to exit the pandemic recession, policymakers are already tightening credit and housing policies.

The Bank of Korea took its first steps toward normalization at its latest meeting, with a more hawkish tone in its statement and press conference. By contrast, in the wake of a large second infection wave in India, the Reserve Bank of India could continue to add to its accommodative measures with additional bond purchases and by relaxing regulatory controls and enhancing liquidity measures.

As noted above, most advanced economies have increased fiscal stimulus to deal with the pandemic and confinement measures. Conditional on continued economic recovery and successful virus management, a large part of the extraordinary support is expected to be withdrawn over time. This would result in a tightening of the fiscal stance across countries as measured by a change in the government primary balance. Changes in the overall fiscal stance should be calibrated to overall economic conditions. Too abrupt a removal of fiscal stimulus could threaten the recovery. Too profligate a stance for too long, meanwhile, would further fuel inflation pressure. The infrastructure spending bill currently being negotiated would provide another dose of fiscal stimulus in the US, however, the size, scope, and odds of the bill becoming law are still very much uncertain.

Growth vs. Value

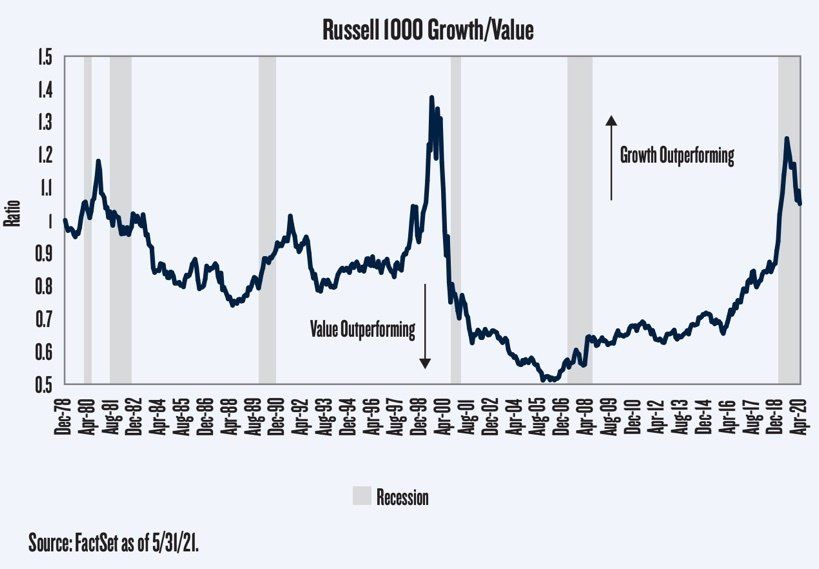

Value Is Still Cheap and Coming Off More Than a Decade of Underperformance: If we are correct, and the cycle has, indeed, turned, it’s likely early days in the outperformance of Value. As shown in Figure 2, style cycles tend to move in multi-year waves. The latest Growth cycle was particularly long at 14 years! As a point of reference, the last Value cycle lasted eight years (2000-2007), however, the most explosive period of outperformance was during the first two years. With Value outperformance beginning last September, we are just nine months into a Value phase.

Meanwhile, Value continues to look cheap relative to Growth on a relative PE basis. Growth stocks typically sell at higher earnings multiples, but the current difference in PE multiples is still more than a standard deviation above its historic average (Figure 3). That is, the PE for Growth is currently 30.2 versus 18.6 for Value, more than an 11-point gap compared to a long-term average of about 5.5.

While growth and value stocks have been battling one another in terms of performance, we had favored growth for several years, though we reduced growth exposure in Q2 2021 to add value exposure, which we believe is poised to outperform as the economic reopening matures.

We’d like to leave you with the understanding that while inflation and central bank policy are significant factors in setting the stage for equity performance going forward, history has shown that the factors underlying policy shifts win the day in the long run.

The markets may continue to experience some near-term volatility thru summer as policy shifts are front and center in investors minds, but given growth in corporate earnings is strong, consumers are spending, and Fed policy shifts are intended toward neutral not hawkish, we see plenty of opportunity for investors.

Be Well.

Alpha Fiduciary is an SEC registered investment advisory firm. The information contained herein should not be construed as personalized investment advice and should not be considered as a solicitation to buy or sell any security or investment advisory services. All investments include a risk of loss. Past performance is no guarantee of future results, and there is no guarantee that future investments will be profitable. For more information please contact Alpha Fiduciary or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) to review our Form ADV Brochure.